Open Your Account Now and Start Trading Online.

You can now open your online account to start trading online.

About Oriental Securities | OSL

Oriental Securities (Pvt.) Ltd. (OSL) is a dynamic organization engaged in buying, selling and dealing in “securities” including stocks, transferable shares, scrips, modarba certificates, notes, debentures, debenture stocks, participation term certificates, bonds, investment contracts, forward or futures contracts, etc. listed on Pakistan Stock Exchange (PSX) (formerly Karachi Stock Exchange Ltd.). OSL besides being a TRE Certificate (No. 148) holder of Pakistan Stock Exchange Ltd. is also licensed Broker (No. BRP-115) of SECP for carrying on the activities of dealing in securities and carrying on such other activities as are permissible by PSX.

Registered

PSX Broker

Online

Trading

3 Decades

in Industry

Uninterruptible

Guidance

NTN

1336933-4

High Customer

Loyalty

Hassle free

Procedures

Dedicated

Team

Open Your Account Today!

Let us take the next investment step together.

Account Opening Requirements

Please see the requirements to open a trading account as an individual.

Account Opening Form

In order to assist you in online account opening process, please fill & send this form to us.

Update Account Details

Use Change of Particulars Form to update details of your trading account.

Our Best Services

Equity Brokerage

Being Licensed Stock Broker of the Pakistan Stock Exchange, OSL facilitates trading on all counters...

Online Trading

OSL also facilitates its clients (after prior arrangement) with easy, accessible and real time equity...

Back Office

At the close of market on every trading day, data is uploaded for scrutiny in Back Office...

State of the Art Trading Platform Available For

Desktop / Mobile / Tablet

- Instant Executions and Confirmations on Stock Trades

- Live Market Rates & Quotes along with Globally accessible

- Depth of Market for each Symbol giving MBO (Market by Order), MBP (Market by Price

- Live Intraday & History charts and Price History for each Symbol

- Instant execution of orders via OMS Gateway of PSX

- Online reports regarding outstanding orders, executed trades, live Margin and Portfolio valuation etc.

- Confidentiality on all customer transactions

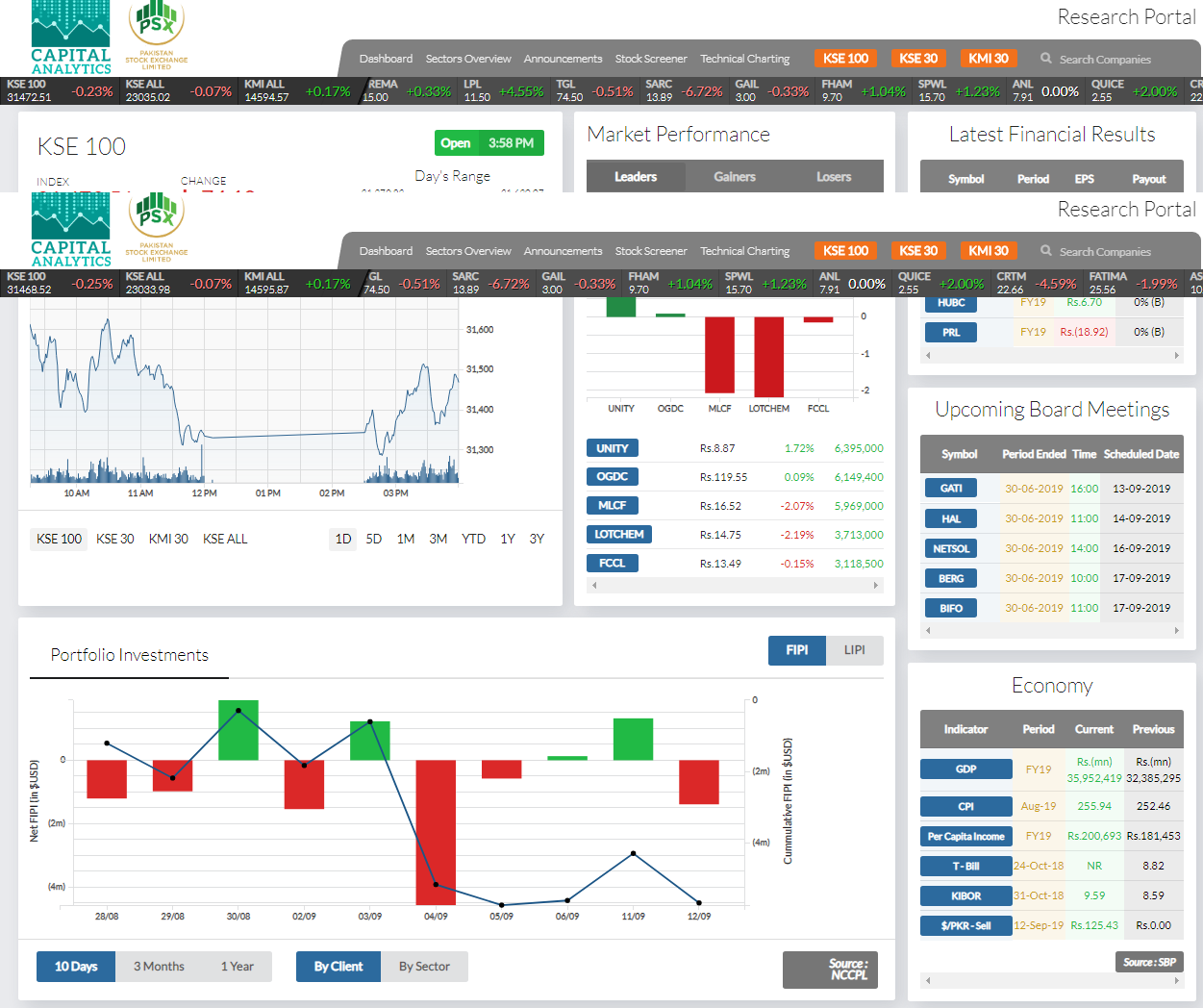

Access to Capital Analytics

Financial Analytics Platform for Fundamental & Technical Analytics

Stock Screener

Financial Indicators

Powerful Visualization

Comparison Tools

Sectors Overview

Technical Charting

Fundamental Indicators

Industry Specific Fundamental Indicators

Qualitative Indicators

Standardized Financial Statements & Comprehensive Qualitative Indicators